|

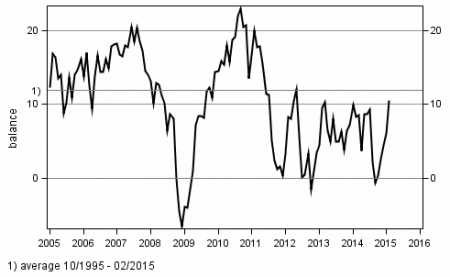

Fri, 27 Feb, 2015 02:46:57 AM FTimes Report, Feb 27  Source Statistics Finland. The consumer confidence indicator stood at 10.6 in February, having been 6.0 in January and 4.4 in December, according to Statistics Finland’s data.

One year ago in February, the consumer confidence indicator received the value 8.3.

The long-term average for the confidence indicator is 11.8. Consumers’ confidence in all four components of the consumer confidence indicator improved in February from January as per the data based on a Consumer Survey, for which 1,276 people resident in Finland were interviewed between 2 and 17 February.

Consumers' estimates about the future of Finland's economy improved the most.

Expectations on own and Finland’s economy were moderate in February and the views on own saving possibilities were good.

By contrast, consumers’ expectations on the development of unemployment were still gloomy.

In February, consumers regarded the time favourable for taking out a loan, but also for buying durable goods.

In February, the personal threat of unemployment experienced by employed consumers was roughly at the same level as in January and one year earlier in February.

In February, 35 per cent of consumers believed that Finland’s economic situation would improve in the coming twelve months, while 24 per cent of them thought that the country’s economy would deteriorate.

In January, the respective proportions were 27 and 29 per cent and twelve months ago 33 and 25 per cent.

In all, 26 per cent of consumers believed in February that their own economy would improve, while 12 per cent of them feared it would worsen over the year.

Twelve months earlier the corresponding proportions were 23 and 12 per cent.

Altogether, 50 per cent of consumers thought in February that unemployment would increase over the year, and 16 per cent of them believed it would decrease. The respective proportions in January were 56 and 13 per cent.

Twenty-five per cent of employed persons reckoned in February that their personal threat of unemployment had grown over the past few months, while 11 per cent thought it had lessened.

Forty-six per cent of employed persons thought the threat had remained unchanged and 17 per cent felt that they were not threatened by unemployment at all.

Consumers predicted in February that consumer prices would go up by 1.0 per cent over the next 12 months, the data show.

In January, the inflation expectation was still 1.7 per cent and one year ago 2.6 per cent.

Saving was considered worthwhile by 50 per cent of consumers in February. In all, 66 per cent of households had been able to lay aside some money and 80 per cent believed they would be able to do so during the next 12 months.

In February, 65 per cent of consumers regarded the time good for raising a loan. One month ago the respective proportion was 59 per cent and one year ago 57 per cent.

More News

|

|

Finland Times

| Sunday, 16 November, 2025 |