|

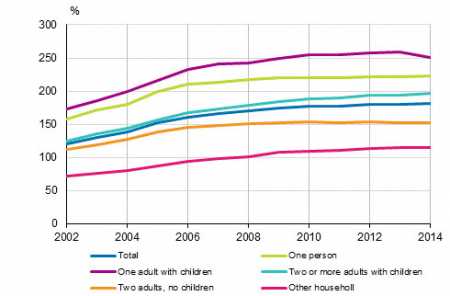

Wed, 27 Jan, 2016 12:03:43 AM FTimes Report, Jan 27  Share of housing loans in the income of household-dwelling units with housing loans in 2002 to 2014. Source: Indebtedness 2014. Statistics Finland. The average housing loan for household-dwelling units was 181 per cent of their annual income in 2014, according to Statistics Finland.

Families with children of two supporters had the biggest housing loans, EUR 125,700 per indebted household-dwelling unit. Relative to income, household-dwelling units with just one adult were the most in debt.

The housing loan among single supporters was, on average, 250 per cent of their annual income and among those living alone 223 per cent.

The average housing loan for household-dwelling units EUR 94,370, the data show.

Two-supporter families with children had most often a housing loan, of whom 71 per cent were with housing loans. Of single-supporter families, 39 per cent had housing loans.

The indebtedness of childless household-dwelling units varied considerably by age.

Of those living alone, people aged 35 to 44 had most often housing loans, of whom 38 per cent had a housing loan.

In childless household-dwelling units with two adults, 30 per cent had housing loans, among whom most often those aged 35 to 44, among whom 60 per cent had housing loans.

The rate of indebtedness of all household-dwelling units, that is, the share of their debts in their disposable income, was 111 per cent in 2014, while in 2002 it was 70 per cent.

Debts of household-dwelling units grew clearly over the past decade, but in recent years, the growth in debts has slowed down.

In 2002 to 2010, the debts of household-dwelling units grew in real terms by 97 per cent, but in 2010 to 2014 by not more than three per cent.

In 2013, the rate of indebtedness of all household-dwelling units was 110 per cent, as it was in 2010.

In one-third of indebted household-dwelling units, that is, 470,500 household-dwelling units, debts were at least two times as high as their disposable annual income.

Household-dwelling units where the reference person was aged 35 to 44 were generally the most indebted. Among household-dwelling units with housing loans whose reference person was aged 35 to 44, the debts of every second were at least three times higher than their annual income.

In 2014, there were 1.4 million indebted household-dwelling units, that is, 53 per cent of all household-dwelling units. Household dwelling units' total debts amounted to EUR 112 billion. Seventy-four per cent of debts were housing loans.

Household-dwelling units' other debts taken out for consumption or purchases amounted to EUR 21.1 billion, study loans to EUR 1.8 billion and debts for business purposes to EUR 6.7 billion.

Study loans increased most, by seven per cent from the year before. But housing loans did not grow any more in 2014.

Household-dwelling units paid EUR 2.0 billion in interests in 2014. Average interest expenses per indebted household-dwelling unit were EUR 1,430 as per the statistics.

Compared with 2002, household-dwelling units paid in real terms nearly one-third less in interest expenses even though their debts doubled over the same period.

More News

|

|

Finland Times

| Thursday, 29 January, 2026 |