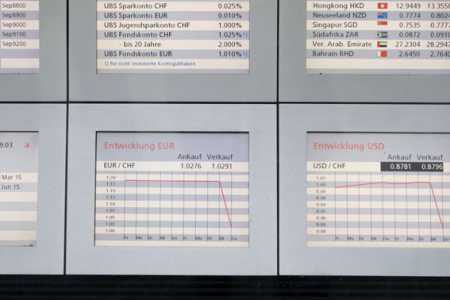

Tue, 13 Jan, 2015 12:00:49 AM FTimes- Xinhua Report , Jan. 16  A picture taken on January 15, 2015 shows exchange rate boards displaying the euro / Swiss Franc, USD / Swiss Franc currency exchange rate charts and various currency rates at a branch of Swiss banking giant UBS in Zurich. European stock markets diverged today after Switzerland's central bank scrapped a policy to artificially hold down the value of the Swiss franc against the euro, sending the franc soaring. Following the announcement, the Swiss franc strengthened 29 percent to 0.8517 against the euro. Photo AFP-Lehtikuva The Swiss National Bank (SNB) surprisingly announced on Thursday that it is removing its minimum exchange rate of Swiss franc 1.20 per euro, leading the Swiss franc surged to a high level against the euro.

Thursday's announcement put an end to the longstanding policy staged out by the central bank of Switzerland around three years ago in an effort to defend the Swiss economy from the euro area's debt crisis.

Since September, 2011, the SNB has introduced the ceiling due to massive overvaluation of the Swiss franc, which has posed an acute threat to the Swiss economy and carried the risk of a deflationary development.

To enforce and maintain this minimum rate, the Swiss central bank has been purchasing foreign currency in unlimited quantities.

"The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm," the SNB said in the statement.

"While the Swiss franc is still high, the overvaluation has decreased as a whole since the introduction of the minimum exchange rate. The economy was able to take advantage of this phase to adjust to the new situation," the central bank announced.

Given the considerable depreciation of euro against the U.S. dollar and the subsequent weakening of the Swiss franc, the SNB concluded that "enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified".

Meanwhile, the SNB is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold to -0.75 percent.

The move is "to ensure that the discontinuation of the minimum exchange rate does not lead to an inappropriate tightening of monetary conditions", according to the bank.

The SNB added that it will continue to pay close attention to the exchange rate situation, and "if necessary, it will therefore remain active in the foreign exchange market to influence monetary conditions".

More News

|

|

Finland Times

| Sunday, 16 November, 2025 |