|

Sat, 19 Dec, 2015 03:09:41 AM FTimes Report, Dec 19

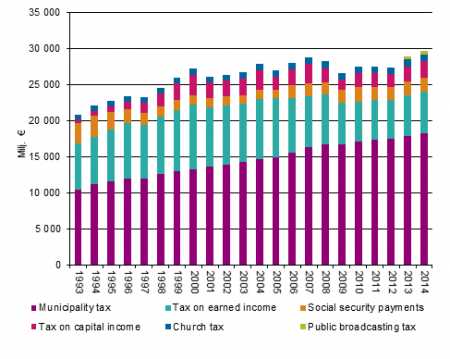

Of the taxes, taxes on capital income amounted to EUR 2.4 billion, income tax to EUR 5.7 billion and municipal tax to EUR 18.3 billion. Compared to the year before, the amount of taxes on capital income, by 12.1 per cent grew most, when income tax went up 0.6 per cent and municipal tax by 3.7 per cent. Income earners paid EUR 1.3 billion in healthcare contributions, EUR 713 million in earned-income contribution payments and EUR 499 million in public broadcasting tax. In 2014, the share of municipal tax in direct taxes was 62 per cent, having been 50 per cent in 1993. The share of state income tax in taxes diminished during this time from 31 to 19 per cent. Taxes on capital income accounted for 8.0 per cent of taxes, sickness insurance contributions for 6.6 per cent and the public broadcasting tax for 1.7 per cent. In total, taxes and payments have increased by 39 per cent in real terms from 1993, the statistics show. Taxable income received by income earners totalled EUR 131.4 billion, of which earned income amounted to EUR 122.7 billion and capital income to EUR 8.7 billion. From the year before, the income grew in nominal terms by 2.4 per cent, earned income by 1.8 per cent and capital income by 12.2 per cent. Earned income was received by 4.6 million persons and capital income by 1.4 million. Earned income increased most due to pensions and benefits based on unemployment security. Taxable capital income grew more than earned income, partly due to the fact that a larger part of dividends than before were taxable income. Income earners received taxable dividends from listed shares to the tune of EUR 932 million and from unlisted shares EUR 717 million. Dividends from listed shares grew by 38 per cent, but those received from unlisted share went down by 1.7 per cent. Income earners received EUR 4.1 billion in transfer gains and EUR 1.5 billion in rent income. Transfer gains grew by 6.4 per cent and rent income by 4.4 per cent. More News

|

|

Finland Times

| Sunday, 19 October, 2025 |