|

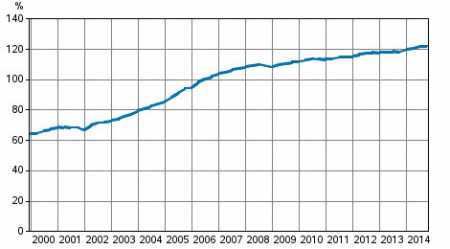

Thu, 02 Apr, 2015 12:03:55 AM FTimes Report, April 2  Households’ indebtedness ratio. Source: Financial accounts, Statistics Finland. Households’ indebtedness ratio rose to 122.2 per cent in the last quarter of 2014.

Indebtedness grew by 3.7 percentage points from one year ago, according to the data derived from Statistics Finland’s financial accounts statistics.

Households' loan debts increased by euro 0.8 billion to euro 132.3 billion during the fourth quarter of 2014.

Households' disposable income also grew, but relatively less. As a result of the changes, households' indebtedness ratio increased to 122.2 per cent.

The indebtedness ratio went up by 0.5 percentage points from the previous quarter.

Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

At the end of 2014, households had a total of euro 259.6 billion in financial assets and euro 141.3 billion in debts.

During the last quarter, financial assets grew by euro 1.2 billion and debts by euro 0.1 billion. Households' net financial assets consequently increased to euro 118.3 billion at the end of the quarter.

During the fourth quarter, households' net investments amounted to euro -0.3 billion. Despite this, households' financial assets increased, thanks to holding gains.

Households withdrew assets from quoted shares and debt securities. The popularity of mutual funds, however, continued and households' net investments in mutual fund shares was euro 0.3 billion.

The shift within deposits from fixed-term deposits to cash deposits continued as per the show.

Non-financial corporations' debt financing grew by euro 0.6 billion in the last quarter.

More News

|

|

Finland Times

| Monday, 06 May, 2024 |