|

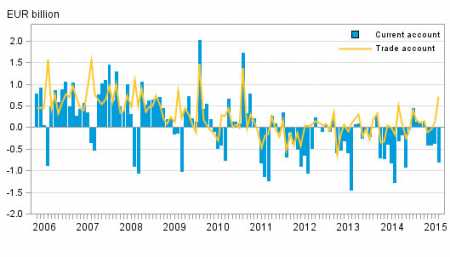

Tue, 16 Jun, 2015 12:03:13 AM FTimes Report, June 16  Finland’s current account and trade account. Source: Balance of payments and international investment position, Statistics Finland. Net capital inflow to Finland amounted to EUR 5.0 billion in the first quarter of 2015, according to Statistics Finland.

The main source of inward capital flow on net was direct investments, EUR 9.5 billion.

Correspondingly, outward capital flow on net was mainly in the form of other investments (loans, deposits and trade credits), totalling EUR 3.5 billion, the data show.

The trade account was in balance during the period in balance of payment terms On the financial account side there was net capital inflow, mainly in form of direct investments.

In April, the trade account was pushed into surplus as exports increased slightly and imports decreased further, the data show.

Exports of goods made a downturn as goods exports to Russia declined strongly. Service exports remained on last year's level.

The current account was EUR 1.2 billion in deficit in the first quarter. The deficit was generated from the service, primary and secondary income accounts.

Finland’s current account and trade account, 12 –month moving sum. Source: Balance of payments and international investment position, Statistics Finland. The total value of goods exports was EUR 12.9 billion in the first quarter of 2015.

Excluding Russia, goods exports in the first quarter remained on level with the previous year.

Service exports amounted to EUR 4.8 billion in the first quarter as the telecommunications, computer, and information services item grew clearly to EUR 1.9 billion, according to the statistics.

In most service items the year-on-year changes were small and service exports remained on last year's level.

Service exports were depressed by the decrease in consumption by Russian visitors in Finland. Foreign tourists' consumption in Finland is recorded as service exports and it amounted to EUR 0.6 billion in the first quarter.

The value of goods imports in balance of payment terms, EUR 12.9 billion, decreased by 4.7 per cent in the first quarter.

The current account was EUR 0.8 billion in deficit in April despite the trade account being in surplus.

One year earlier, in April 2014, the current account showed a deficit of EUR 1.3 billion. The 12-month moving total of the current account was EUR 2.6 billion in deficit.

Finland’s monthly international investment position. Source: Balance of payments and international investment position, Statistics Finland. The deficit in the current account was particularly formed from the primary income account that was EUR 1.3 billion in deficit.

The services account and the secondary income account were also in deficit. The EUR 0.7 billion surplus in the trade account was explained by a decrease in imports.

The value of goods imports in balance of payment terms was EUR 4.1 billion in April and it decreased by 17 per cent from April 2014. Goods exports, EUR 4.8 billion, increased by one per cent.

At the end of March 2015, Finland had EUR 803.3 billion in foreign assets and EUR 811.0 billion in foreign liabilities. Finland's net international investment position was negative EUR 7.7 billion.

Most net debt was found in the other investments item, EUR 37.7 billion. In the first quarter of 2015, the net investment position was depressed by changes in exchange rates and other valuation changes, EUR 2.1 billion, as well as price changes, EUR 1.4 billion.

Investments in Finnish equity and mutual fund shares grew by EUR 1.4 billion but investments in debt securities decreased by EUR 3.5 billion.

Capital flow to foreign securities was EUR 5.5 billion, while EUR 4.6 billion in equity and mutual fund shares were dissolved.

In debt securities, investments in money market instruments increased by EUR 1.9 billion of which a majority was invested by other monetary financial institutions.

During the first quarter of 2015, EUR 8.7 billion in capital flowed to Finland as direct investments, while direct investment made from Finland to foreign countries decreased by EUR 0.8 billion.

Direct investments include both equity and debt-based investments within a group. At the start of 2015, investments from abroad to Finland mainly consisted of debt-based items.

Finland's net investment position improved compared to the situation at the end of March 2015 as the net investment position related to securities turned positive.

Table 1. External assets and liabilities by investment type in 2015 Q1, EUR billion

Source: Balance of payments and international investment position, Statistics Finland.

More News

|

|

Finland Times

| Friday, 26 April, 2024 |