|

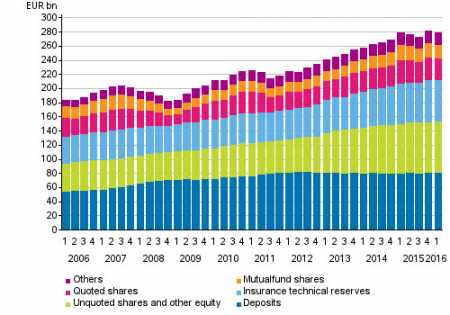

Fri, 01 Jul, 2016 12:01:44 AM FTimes Report, Jul 1  Households’ financial assets. Source: Financial accounts, Statistics Finland. Households’ financial assets declined by EUR 2.7 billion during the first quarter of 2016 falling to EUR 278.3 billion, according to Statistics Finland.

In turn, households’ debts increased by EUR 0.8 billion during the first quarter rising to EUR 148.1 billion. As a result of these changes, households' net financial assets decreased by EUR 3.5 billion to EUR 130.2 billion.

Net financial assets refer to the difference between financial assets and liabilities.

During the first quarter, households decreased their net investments in financial assets by EUR 0.4 billion. Households' net investments in deposits and quoted shares increased but investments in debt securities and investment funds decreased.

Even though households' net investments in financial assets were negative, holding losses were the main reason for the decrease in financial assets as per the data derived from financial accounts statistics.

Households’ loan debts increased by EUR 0.5 billion during the first quarter rising to EUR 138.2 billion. Despite this, households' indebtedness ratio decreased by 0.3 percentage points from the previous quarter to 124.6 per cent.

Non-financial corporations’ debt financing increased by EUR 4.9 billion during the first quarter of 2016 rising to EUR 228.2 billion. Non-financial corporations’ financing in the form of debt securities grew by EUR 2.5 billion to EUR 34.8 billion, while non-financial corporations' loan debts went up by EUR 2.4 billion to EUR 193.4 billion.

Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

Debt financing refers to the total of loan debts and financing in the form of debt securities.

More News

|

|

Finland Times

| Saturday, 27 April, 2024 |