|

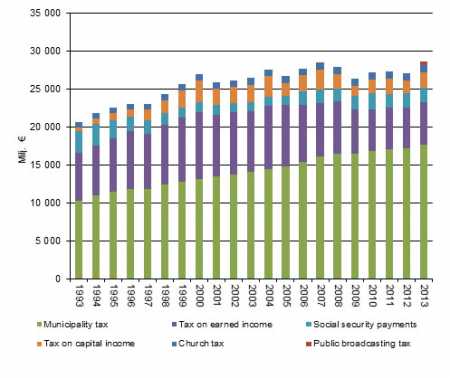

Thu, 18 Dec, 2014 12:02:31 AM FTimes Report, Dec. 18  Income earners’ direct taxes in 1993 to 2013, at 2013 prices. Source: Taxable incomes 2013, Statistics Finland. Income earners paid EUR 28.7 billion in direct taxes and payments in 2013.

Taxes grew by 7.2 per cent from 2012 in nominal terms while taxes on capital income increased most, by 21.6 per cent, according to Statistics Finland’s data.

Four million income earners paid a total of EUR 486 million in public broadcasting tax, which represented 1.7 per cent of direct taxes. On average, EUR 122 was paid in public broadcasting tax, the data show.

Taxes and payments have increased by 38 per cent in real terms from 1993. During the same period, municipal taxes have grown by 71 per cent and its share of direct taxes has grown from 50 to 62 per cent.

At the same time, the share of state taxes went down from 33 to 27 per cent.

The share of taxes on earned income fell from 31 to 20 per cent.

In 2013, EUR 17.7 billion was paid in municipal tax, which was 3.9 per cent more than in the previous year. Altogether, 3.8 million income earners paid the municipal tax.

The amount of income tax grew by 6.9 per cent from the previous year. In all, 1.6 million people paid income tax and 917,000 paid capital tax.

Taxable income received by income earners totalled EUR 128.3 billion, of which earned income amounted to EUR 120.6 billion and capital income to EUR 7.8 billion as per the statistics.

Taxable income grew by 3.2 per cent from the previous year. Capital income grew by nearly 18 per cent, while earned income grew only by two per cent.

Wage and salary income grew by close on one per cent year-on-year.

Income from agriculture decreased by 3.5 per cent and income from groups by 2.6 per cent.

The proportion of taxes and payments in taxable income was 22.4 per cent, which was 21.5 per cent in the previous year.

Taxes and payments here include taxes on earned income and capital income, municipal taxes, church taxes, sickness insurance contributions and public broadcasting tax.

More News

|

|

Finland Times

| Monday, 29 April, 2024 |