|

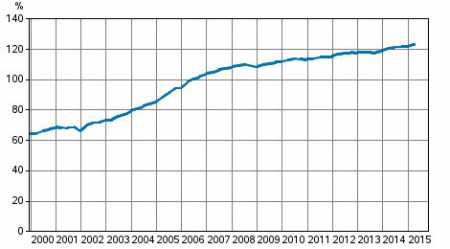

Thu, 01 Oct, 2015 12:06:31 AM FTimes Report, Oct 1  Households’ indebtedness ratio. Source: Financial accounts, Statistics Finland. Households' indebtedness rose by 1.4 per cent to 123.2 per cent in the second quarter of 2015.

Compared to the year before, the change in the indebtedness ratio was 2.7 percentage points, according to the data derived from Statistics Finland's financial accounts statistics.

During the second quarter of 2015, households' loan debts increased by EUR 1.7 billion to EUR 134.8 billion.

Households' disposable income in turn remained almost unchanged. Consequently, households' indebtedness ratio rose to 123.2 per cent.

Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

At the end of June, households had a total of EUR 272.7 billion in financial assets and EUR 144.7 billion in debts.

During the second quarter, financial assets decreased by EUR 1.3 billion and debts by EUR 2.2 billion. As a result of the changes, households' net financial assets decreased and stood at EUR 128.0 billion at the end of the quarter.

The reduction in households' financial assets was due to holding losses.

Households' net investments amounted to EUR 2.1 billion during the quarter, but it was not enough to compensate for the effect of holding losses on financial assets.

Households withdrew assets from quoted shares and mutual fund shares.

In contrast, households relied on deposits, on which they invested EUR 1.6 billion in net amounts during the quarter.

Non-financial corporations' debt financing grew by EUR 4.1 billion in the second quarter with EUR 191.9 billion being in loan debt and EUR 32.6 billion debt in the form of debt securities.

More News

|

|

Finland Times

| Friday, 26 April, 2024 |