|

Sat, 17 Sep, 2016 12:03:02 AM FTimes Report, Sep 17

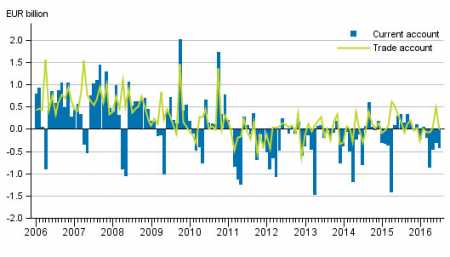

The combined value of exports of goods and services compared with the corresponding period in 2015 now declined for the fourth successive quarter. In July, the decline continued as the value of exports of goods and services decreased by eight per cent. Both foreign assets and liabilities contracted in the second quarter. The net international investment position was positive as per the statistics on balance of payments and international investment position.

In balance of payment terms, the trade account was EUR 0.4 billion in surplus. The value of exports of goods in balance of payment terms declined by three per cent from the corresponding period one year ago and amounted to EUR 13.9 billion. The value of imports of goods in balance of payment terms grew by five per cent from the corresponding period one year ago and amounted to EUR 13.4 billion.

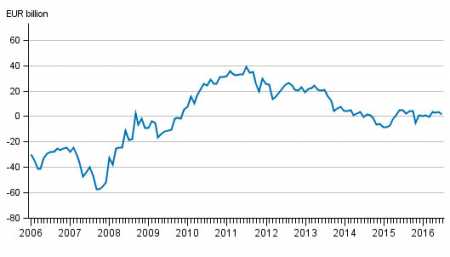

The primary income account was EUR 0.8 billion in deficit, which is mainly explained by the deficit of investment income. The primary income account includes investment income like interests and dividends. The secondary income account was EUR 0.4 billion in deficit. In July, the current account was EUR 0.4 billion in deficit. Of the sub-items of the current account, the services account, the primary income account and the secondary income account were in deficit. In balance of payment terms, the trade account was in balance. The value of exports of goods in balance of payment terms declined by 11 per cent and that of exports of services by one per cent year-on-year. The value of exports of goods in balance of payment terms decreased by seven per cent from twelve months back. In the second quarter of 2016, net capital outflow from Finland amounted to EUR 3.6 billion. Capital inflow was mostly in the form of other investments, that is, for example, as loans, deposits and trade credits from outside the group, EUR 6.6 billion on net. Net capital outflow from Finland was mostly in the form of direct investment, EUR 6.5 billion. At the end of the second quarter, Finland had EUR 735.9 billion in foreign assets and EUR 731.9 billion in foreign liabilities. At the end of the second quarter, foreign direct investment assets on gross stood at EUR 140.8 billion and the corresponding liabilities at EUR 109.7 billion. During the second quarter of 2016, foreign direct investment assets decreased by EUR 5.6 billion and liabilities by EUR 11.2 billion. In the second quarter, foreign portfolio investments decreased by EUR 3.1 billion on net. Holding gains (the effect of changes in prices, exchange rates and other valuation changes) from foreign portfolio investments totalled EUR 2.9 billion in the second quarter. At the end of the second quarter of 2016, outward portfolio investment assets stood at EUR 292.7 billion, of which EUR 145.7 billion were investments in shares and mutual fund shares, and EUR 147.0 billion in bonds and money market instruments. At the end of the second quarter, outward portfolio investment liabilities stood at EUR 300.6 billion, of which EUR 101.5 billion were investments in shares and mutual fund shares, and EUR 199.1 billion in bonds and money market instruments. In the second quarter, portfolio investment liabilities contracted by EUR 3.4 billion when also considering holding gains. Changes in prices increased portfolio investment liabilities by EUR 0.1 billion and other valuation changes by EUR 0.7 billion. In the second quarter of 2016, net capital inflow to Finland of other investments, i.e. loans, deposits and trade credits amounted to EUR 6.6 billion. The net investment position related to other investments weakened by EUR 6.8 billion, when also considering the EUR 0.7 billion effect of price changes and the EUR -0.9 billion effect of other valuation changes. At the end of June, assets from other investments amounted to EUR 185.9 billion and liabilities to EUR 218.8 billion. Of these assets, EUR 164.5 billion and of the liabilities, EUR 189.4 billion were held by financial and insurance corporations. At the end of June, Finland had EUR 3.7 billion derivative-related net assets, which is EUR 1.6 billion more than at the end of March. Both derivative-related assets and liabilities contracted in the second quarter. At the end of June, Finland had EUR 735.9 billion in foreign assets and EUR 731.9 billion in foreign liabilities. The net international investment position was thus positive at the end of the quarter as there were EUR 4.0 billion more assets than liabilities. Both foreign assets and liabilities contracted in the second quarter. Price changes related to foreign assets and liabilities raised the net investment position by EUR 2.1 billion during the quarter. Changes in exchange rates and other valuation changes in turn lowered the net investment position by EUR 1.2 billion. At the end of March 2016, the net investment position was EUR 0.5 billion negative so the net growth was EUR 4.5 billion. Assets declined by EUR 16.1 billion in April to June and liabilities by EUR 20.7 billion. In July, the net capital inflow to Finland was EUR 2.4 billion. Net capital inflow was mostly in the form of portfolio investments, altogether EUR 2.5 billion. Net capital outflow was mostly in the form of direct investments, EUR 0.6 billion. Finland's net investment position was EUR 1.7 billion positive at the end of July, as foreign assets amounted to EUR 754.3 billion and foreign liabilities to EUR 752.6 billion Table 1. External assets and liabilities by investment type, EUR billion

Source: Balance of payments and international investment position, Statistics Finland.

More News

|

|

Finland Times

| Friday, 26 April, 2024 |